Andromeda

Release 2025

Every insurer is unique, and Insurity's goal is to enable our customers to maintain their uniqueness through flexible software. Insurity's latest product release, Andromeda, breaks the cycle of legacy technology that only adds friction. Andromeda turns bottlenecks into speed, noisy data into clarity, and outdated workflows into real competitive advantage for customers.��Every enhancement in Andromeda targets the problems insurers battle every day: quoting delays, disconnected data, manual workarounds, compliance pressure, and the rising cost of inefficiency. This product release brings smarter automation, sharper insights, and faster decisioning embedded directly into everyday workflows.��Andromeda is a faster, stronger, more unified Insurity platform designed to help insurers grow profitably. See what’s new across Insurity's product family:

Policy Decisions

SpatialKey

Insurity Pro Suite

Insurity Underwriting

Insurity Loss Control

Sure Claims

Insurity Workers’ Comp Suite

Insurity Bridge Specialty Suite

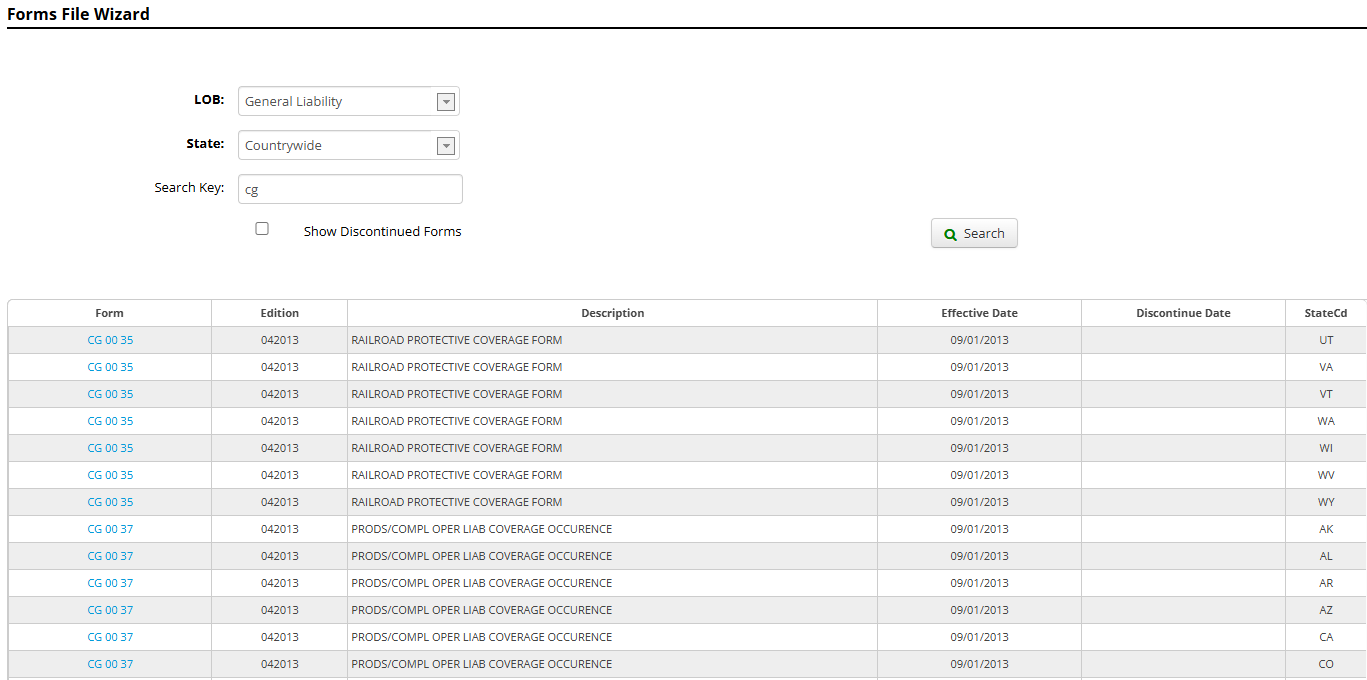

Commercial Lines Manual (CLM) Optimization modernizes how class codes are managed. The CLM now includes versioned data, intelligent lookups, and type-ahead search, ensuring only valid codes appear and that quoting is both faster and more accurate.

�These enhancements turn policy administration from a process into a competitive advantage.

Policy Administration: Transparency and Self-Service

Introducing Insurity’s Andromeda Release:

Bringing AI, Real-time Risk Intelligence, True Rating Transparency, and Instant Frontline Productivity to Insurers

And for catastrophe response, the Event Response Damage Factors feature adds customizable damage percentages by peril and hazard band, improving claim-reserve accuracy and post-event triage.

With Event Response Save and Restore, analysts can also save and restore event dashboards, ensuring customized filters and visualizations persist for consistent, repeatable insights.

�To make these capabilities even easier to access, Single Sign-On (SSO) now connects all SpatialKey applications through one secure login, reducing password fatigue and login errors. Together, these upgrades make analytics not just powerful, but practical, accessible to every part of the insurance value chain.

Data & Analytics: Deeper Intelligence for Better Decisions

Access to real-time information also gets a major upgrade with Claims Tracking for Underwriting, which pulls claims data directly into the underwriting process. Underwriters can now assess past losses before binding coverage, giving them the full picture of a risk without switching systems.

Insurity Pro Suite and Underwriting: Connected Decisions, Faster Results �

Discover how Insurity’s Andromeda release can accelerate your digital transformation. �Visit www.insurity.com or contact your Insurity representative to learn more.

Experience the Andromeda Release

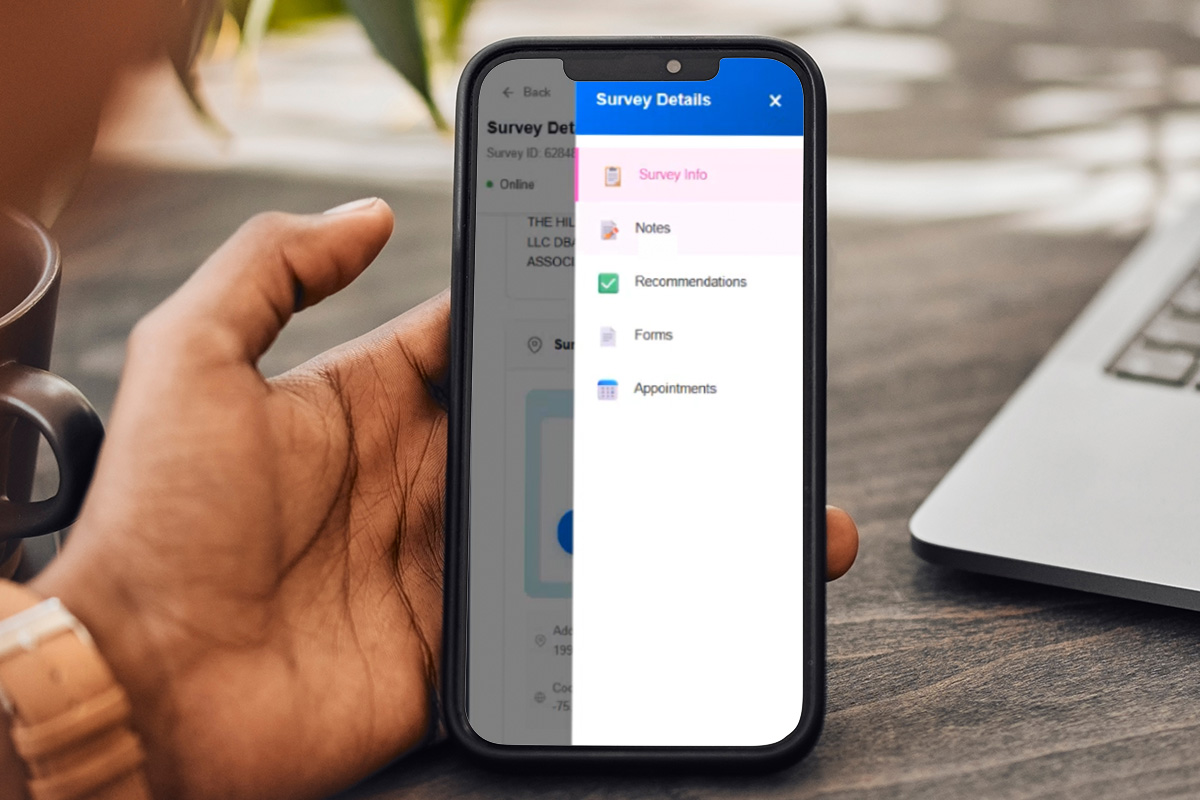

Risk management doesn’t stop at the office and neither should the tools that support it. The new Loss Control Mobile App delivers true mobility for risk consultants in the field. With full online and offline functionality, surveyors can capture inspection data, photos, and notes on any device, even without a network connection.

Data syncs automatically once online, eliminating manual reentry and dramatically improving turnaround times. For insurers already piloting the tool with field teams, it’s transforming how efficiently they capture and manage risk information.

Loss Control: Transforming On-Site Risk Assessment�

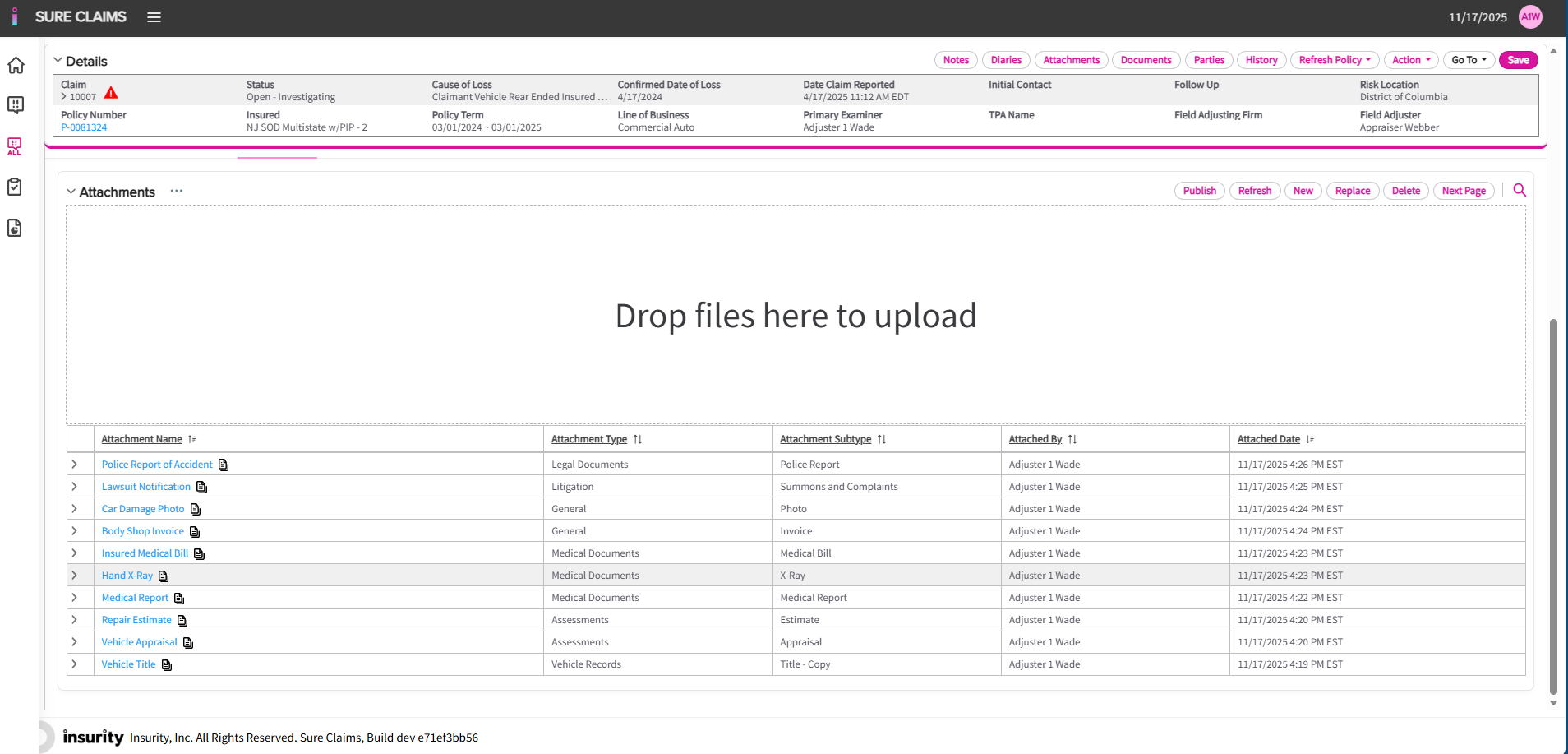

Claims teams thrive on precision, but too often, workflows get buried under manual data entry and inconsistent documentation. The Andromeda release enhances Sure Claims to bring structure, speed, and visibility to claims handling.

New attachment improvements let insurers define custom types and subtypes, improving consistency and traceability across files.

Claims: Smarter, Faster, and More Transparent

Workers’ Comp: Smarter Workflows, Stronger Compliance

Speed matters when every second between configuration and delivery counts. The latest updates to Insurity Bridge Specialty Suite make building, updating, and managing policies smoother than ever.

With the new Offline Republishing capability, product configurators can continue making changes while the publishing process runs in the background. No more waiting for updates to complete before moving forward, this enhancement keeps productivity uninterrupted and ensures teams can make the most of their time in the system.

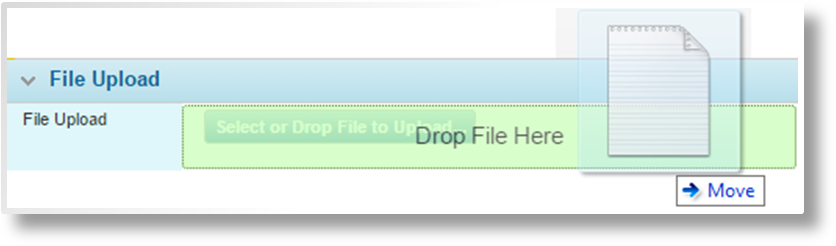

Meanwhile, Drag & Drop for Policy Attachments simplifies one of the most common tasks users perform. Instead of manually uploading files, users can now drag content straight from their desktop into the policy attachment widget, automatically linking it to the policy. It’s faster, more intuitive, and eliminates unnecessary steps in the documentation process.

Bridge Specialty: Efficiency that Keeps Work Moving

The Andromeda release is all about freeing insurers from rigid systems and empowering them with intelligent and flexible tools to match how they run their unique businesses. By connecting underwriting, policy, analytics, and claims through intelligent automation and design, Insurity is giving insurers the agility to act faster, operate smarter, and grow more confidently.

Backed by a $50 million investment in R&D, these advancements mark the start of a new era for Insurity and its customers, one where innovation is continuous across every product, AI is practical, and technology evolves as quickly as the market demands.

Andromeda is the first step in a new rhythm of progress, one that keeps every Insurity customer at the forefront of insurance technology.

Andromeda: Built for Insurers Who Move Fast

Andromeda

Release 2025

Policy administration should be seamless. Insurers have long been constrained by rigid systems and workflows that bury simple actions in unnecessary complexity. Andromeda eliminates those bottlenecks with intuitive design, transparent processes, and self-service tools that put control back in insurers’ hands.

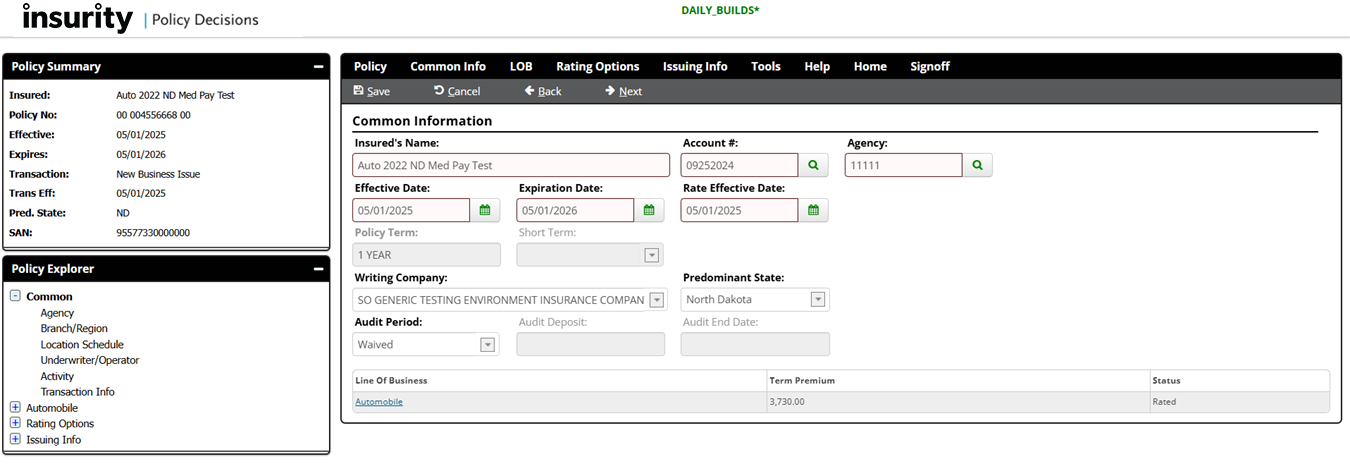

The enhanced UI workflow in Policy Decisions is designed directly from customer feedback. Fields are better grouped, layouts are optimized, and navigation is faster, allowing users to complete policy actions with fewer clicks and less friction. This has been completed initially for Common and Auto and will be followed by Workers’ Compensation.

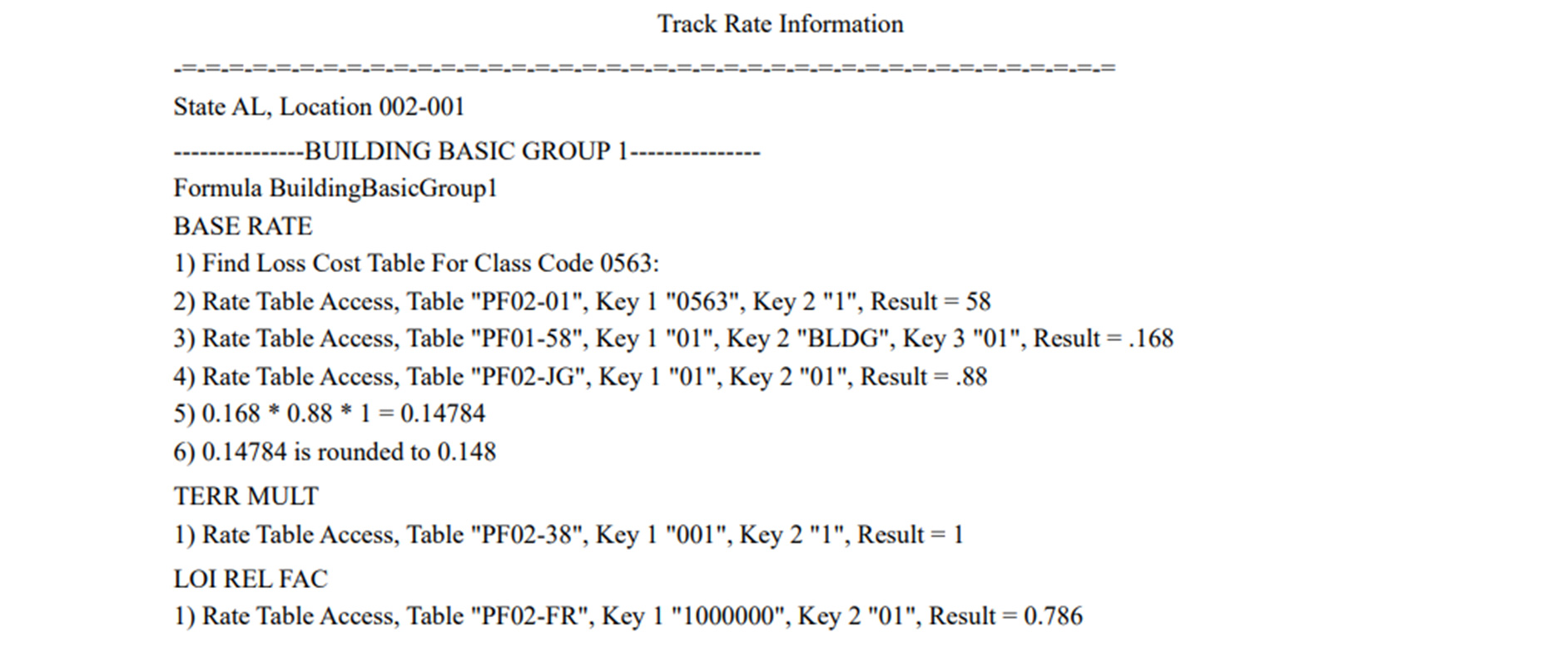

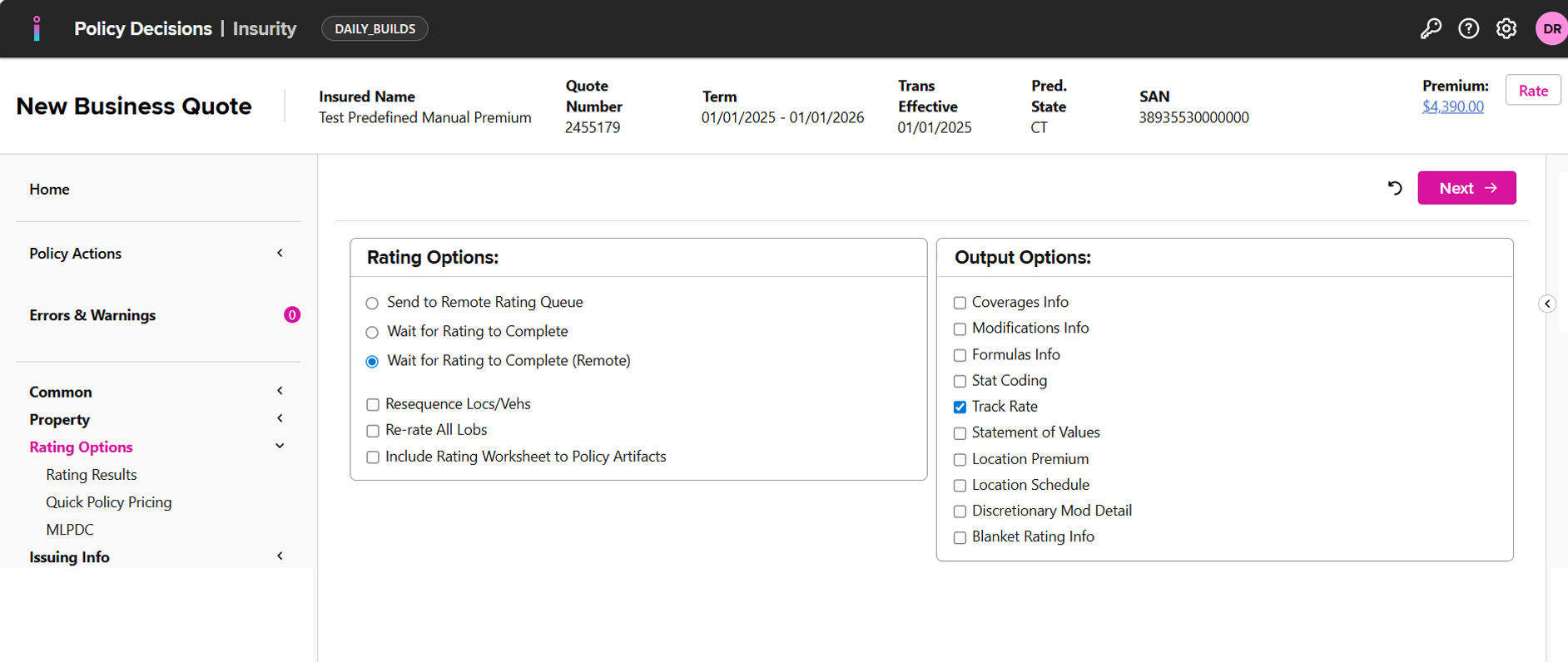

Transparency is also front and center. Policy Decisions now offers fully transparent ratings through its new Track Rate capability, giving underwriters full visibility into how premiums are calculated, showing every table, formula, and applied coverage adjustment in real time. That means faster verification, higher accuracy, and greater confidence in every quote.

Transparency is also front and center. Policy Decision’s new Track Rate capability gives underwriters full visibility into how premiums are calculated, showing every table, formula, and applied coverage adjustment in real time. That means faster verification, higher accuracy, and greater confidence in every quote.

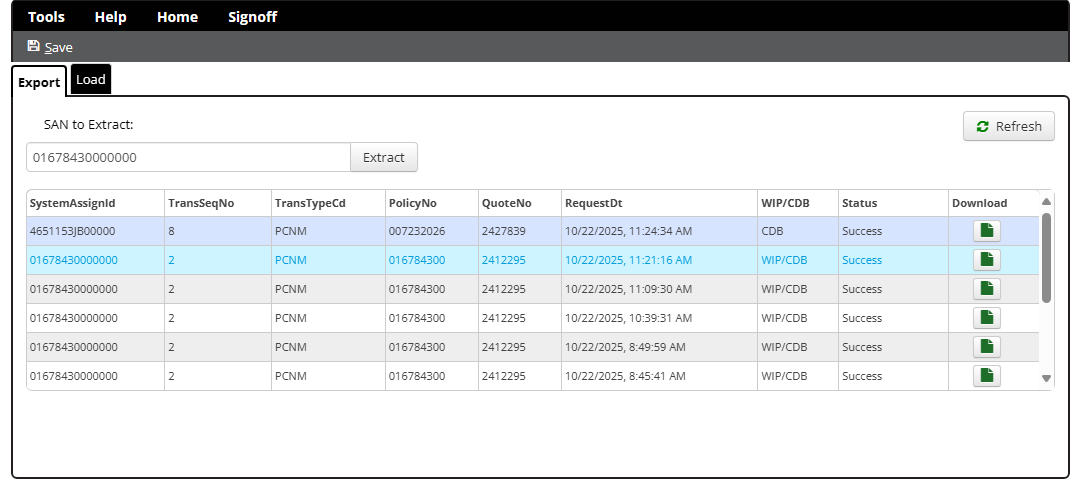

Andromeda also introduces features that make insurers more self-sufficient, including:

Web Polprint now allows hosted customers to extract and migrate policy data independently – with no help-desk tickets required.

The Forms File Wizard lets users instantly review and export the forms tied to each release.

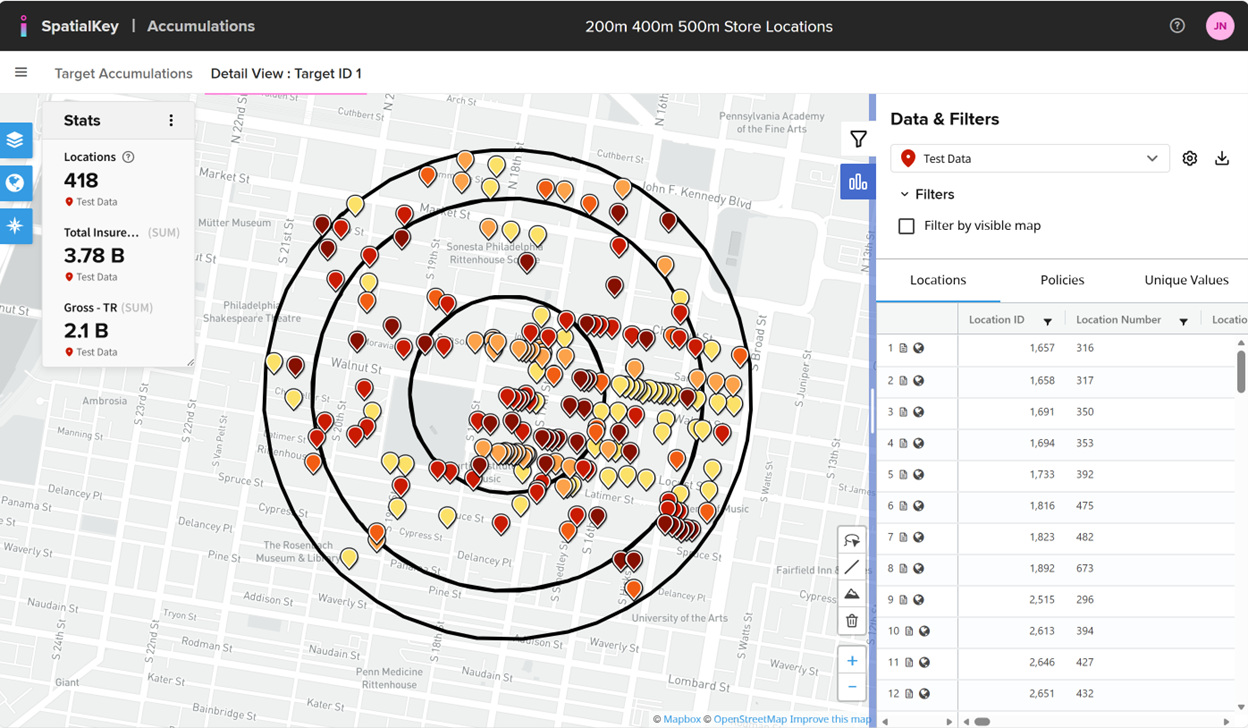

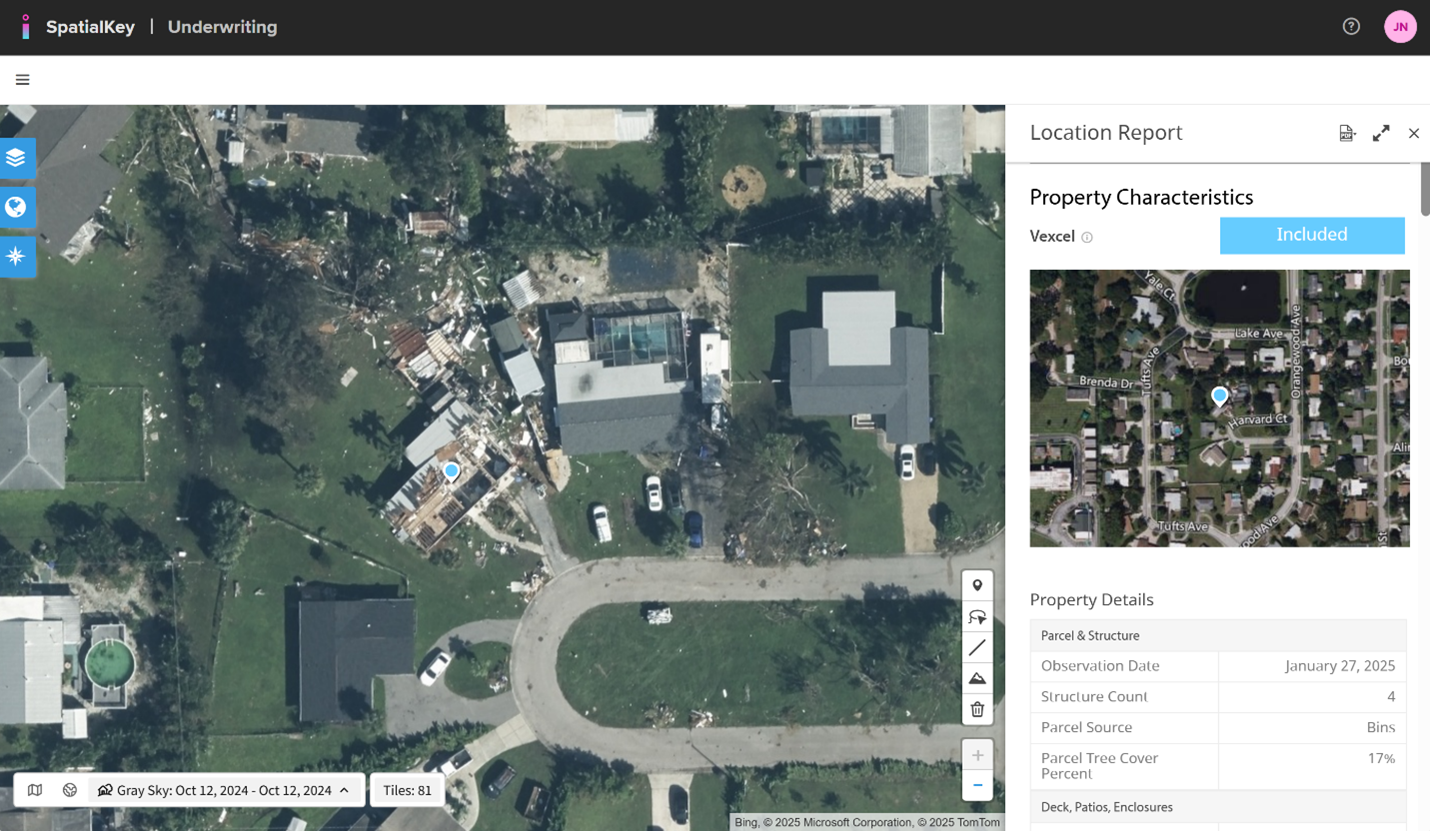

Insurers sit on mountains of data. But insight only matters if it’s actionable. The Andromeda release enhances SpatialKey with new automation features that make analytics faster, smarter, and fully integrated into underwriting and portfolio management.

Here are some of the top new features in the Andromeda release for SpatialKey:

Analysts and portfolio managers gain more powerful modeling tools with Concentric Ring Accumulation Analysis, which supports multiple rings and damage percentages for deeper, more realistic catastrophe scenarios.

Those insights are now easier to automate, thanks to the new Underwriting Accumulation API, which returns instant accumulation results via API for both single and batch locations, eliminating manual lookups and accelerating quote turnaround.

SpatialKey now integrates AI-derived property data and high-resolution imagery from Vexcel, giving underwriters unprecedented visibility into roof quality, building attributes, and hazard proximity. Whether evaluating a property before binding or assessing post-event damage, insurers can act faster and more accurately than ever.

For underwriting teams, time is everything, but disconnected tools and manual data reviews often stand in the way of fast, informed decisions. The Andromeda release brings underwriting, data, and risk evaluation together within Insurity Pro Suite and Insurity Underwriting.

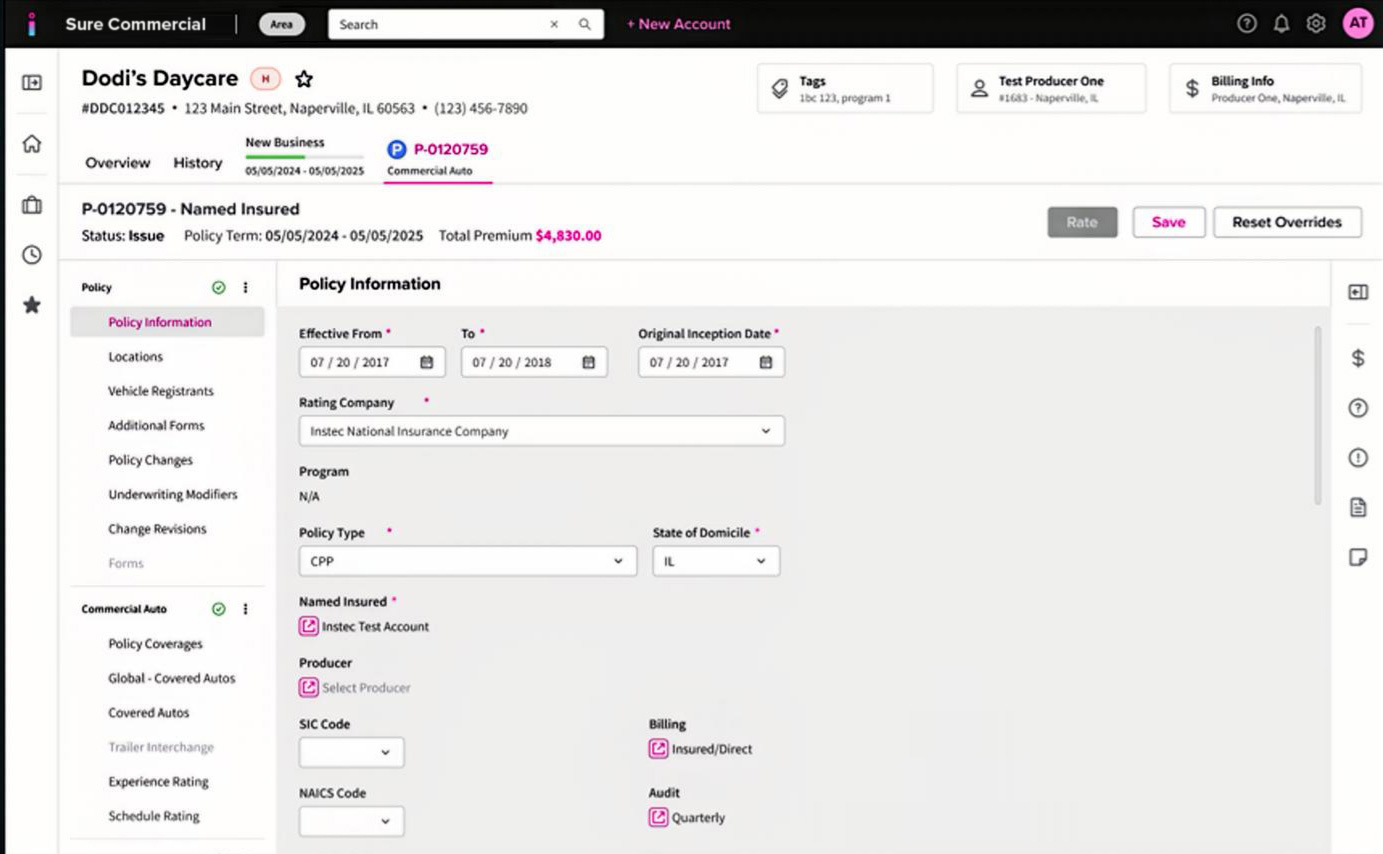

Sure Commercial Browser Mode now integrates directly with Insurity Underwriting in a connected, browser-based experience, allowing carriers and MGAs to evaluate risks, quote, and collaborate from one unified workspace. The result is faster turnaround, fewer hand-offs, and a consistent, intuitive experience that keeps teams focused on decisions instead of data entry.

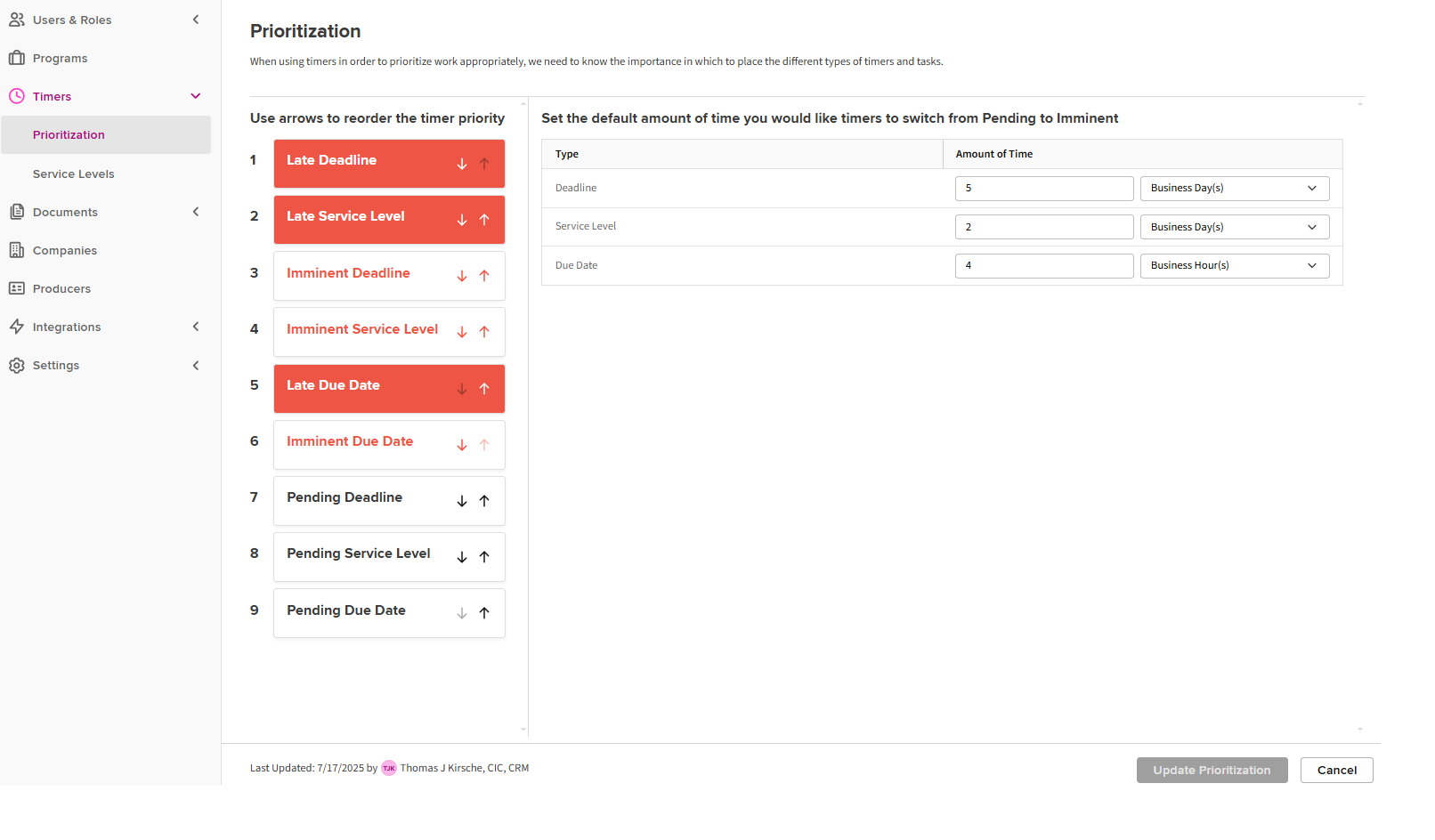

Underwriting Risk Scoring and Prioritization removes that guesswork of which submission to tackle first with a clear, prioritized list of active submissions, each assigned a configurable score based on business rules and external data sources. The score reflects profitability, appetite alignment, and bindability, helping underwriters focus on the best opportunities first, improve conversion rates, and move from decision to bind faster than ever.

Automated capture of salvage assignments and auction details gives adjusters the complete picture at a glance, resulting in fewer errors, faster settlements, and cleaner, more compliant records that simplify both auditing and reporting.

In workers’ compensation, accuracy and compliance can’t afford to slow down productivity. The Andromeda release delivers new automation and workflow intelligence that keep operations efficient and error-free, freeing your teams to focus on what really matters: delivering exceptional service to policyholders and producers.

The new Activity Templates feature lets users link templates to specific task, note, or email types, ensuring only the most relevant options appear when creating new activities. For teams managing large template libraries, this streamlines selection and improves speed. Templates can also now be applied automatically for designated activity types, saving time and ensuring consistency in communications and documentation.

Meanwhile, Mid-Term Producer License Check Automation helps carriers stay compliant by validating agent and branch state licenses automatically when a new unit is added via endorsement. With flexible preference settings, insurers can choose whether to enforce, warn, or skip checks altogether, maintaining control while reducing manual validation work.

�These enhancements make Insurity Workers’ Comp Suite operations faster, more compliant, and more intuitive, empowering your team to work smarter, not harder.